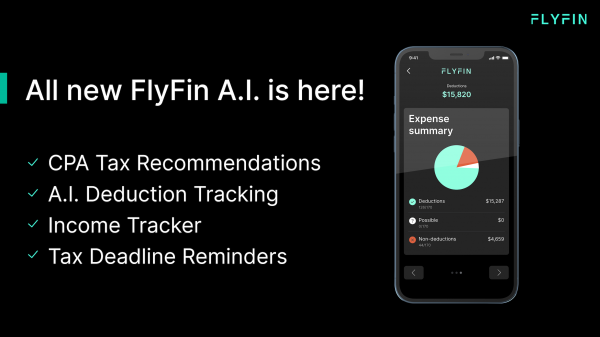

San Jose, CA, United States, 7th Nov 2022 — FlyFin, the world’s number one AI-based tax preparation and tax filing service, announced the addition of powerful, time-saving features to its flagship offering. Core Web 3.0 aspects of artificial intelligence (AI) and machine learning (ML) are now central to FlyFin’s platform, where AI and ML perform a majority of the work for tax filing, reducing user effort by 95 percent. With centralized ML, FlyFin’s platform applies deep learning to financial transactions, income, expenses and tax deductions, while decentralized ML enables learning at the user level. With FlyFin, it doesn’t matter if a user switches their employer or financial institution because individual learning is carried forward and applied to every entity as the AI continues to evolve. FlyFin’s users will benefit from the following new functionality:

- Continuous expense tracking delivers comprehensive tax savings insights 24/7, 365 days per year. FlyFin’s AI constantly extracts meaning from the Semantic Web and learns from users as they classify their expenses on the go, reducing user effort while maximizing savings over time. As FlyFin’s AI learns, it becomes more accurate in suggesting deductions and potential savings, finding any red flags that may lead to IRS penalties or missed deadlines.

- AI-based guided navigation advises users how to classify deductions, flagging any errant or outlier classifications.

- An AI-based, near real-time tax deduction tracking application provides users with continuous, instant categorization and classification of expenses.

FlyFin recently won the prestigious 2022 AI TechAward for Best in Consumer AI technology in recognition of its cutting-edge Web 3.0, AI-powered tax platform. FlyFin has also created the world’s largest freelancer community for taxes and finances on Instagram, attracting more than 50,000 members into the community in just four months. Freelancer and self-employed taxes and finances are challenging. As a result, FlyFin’s vibrant community is gaining traction over traditional personal finance channels as a place where people can learn and help each other.

Building upon the company’s award-winning AI platform, FlyFin has assembled a comprehensive Tax Resource Center that helps freelancers and self-employed individuals prepare and file their taxes. Taxpayers can quickly find topics around self-employment, tax deductions, self-employed retirement plans, and practical how-to guidance. To demystify tax preparation, FlyFin’s growing Tax Resource Center offers an array of free tools, calculators, guides and tax forms:

- A free 1099 Tax Calculator makes it easy for 1099 self-employed individuals to quickly compute the quarterly or annual income tax they owe. Individuals who receive 1099 Forms are self-employed, sub-contractors, independent contractors, gig workers, freelancers and creator economy workers. FlyFin squarely addresses 1099 self-employed individuals and independent contractors’ tax preparation pain, including accounting and tax filing uncertainties and identifying what 1099 deductions qualify.

- The company’s free Tax Form Wizard shows 1099 taxpayers the IRS tax forms that apply to their needs as self-employed individuals. It also provides recommendations for forms specific to their work and situations.

- Its Quarterly Tax Calculator is a fast and accurate tool to estimate quarterly taxes for 1099 workers, freelancers and self-employed individuals. Using the tool, taxpayers learn how to determine estimated taxes and can file quarterly taxes within minutes. FlyFin’s quarterly tax calculator is the only one that considers a person’s income and deductions. The tool enables business owners and self-employed individuals to assess how different income and deduction amounts can affect their overall taxes owed.

- FlyFin’s Earned Income Credit Calculator (EITC) helps taxpayers quickly determine if they qualify for the credit and how much they can receive. The credit reduces the taxes owed on a dollar-for-dollar basis, making it potentially even more valuable than tax deductions. Notably, the tax credit is refundable, meaning that if it’s more than the taxes a taxpayer owes, the tax filer will receive the difference as a refund. FlyFin’s EITC calculator lets taxpayers know what they can receive through the EITC and how to receive it.

- A new Self-Employment Hub helps self-employed people planning to take the next step to formalize their small businesses. The hub provides information about which organizational structure would be most beneficial for their business, outlining the tax implications of each model. It also provides a Business Structure Advisor tool that guides people in determining the ideal business structure for their small businesses.

“Our Web 3.0, AI-based tax engine enables us to provide the most comprehensive, accurate tax prep and filing experience. By leveraging the power of AI and ML, we can reduce users’ efforts by 95% while providing real-time tax deduction tracking and guidance. These features, combined with our growing Tax Resource Center, provide our users with improved efficiency, personalized insights and everything they need to prepare and file their taxes confidently,” said Jaideep Singh, FlyFin’s CEO.

About FlyFin

FlyFin is an award-winning, AI-powered, web 3.0 platform that provides self-employed, sub-contractors, independent contractors, gig workers, freelancers and creator economy workers with a convenient, easy-to-use and affordable tax filing solution. FlyFin helps individuals maximize self-employment tax deductions and income tax refunds. With a “Man + Machine” approach, FlyFin leverages AI paired with highly experienced tax CPAs to deliver automation that eliminates 95% of the work required for 1099 self-employed individuals to prepare their taxes. FlyFin is a privately-held, venture-backed company based in San Jose, California.

Media Contact

Organization: FlyFin

Contact Person: Carmen Hughes

Email: [email protected]

Phone: +1.650-576.6444

Website: https://flyfin.tax/

City: San Jose

State: CA

Country: United States

The post FlyFin Announces Powerful New AI-Based, Web 3.0 Tax Engine appeared first on King Newswire.

Information contained on this page is provided by an independent third-party content provider. King Newswire and this Site make no warranties or representations in connection therewith.

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]